Save with Anchor Protocol, and your future self might thank you.

As decentralized finance (DeFi) gets more mature, it seems that we have seen everything — From Mark Cuban getting involved in the IRON-TITAN fiasco, all the way to a new and upcoming DeFi protocol called “Nonce Finance”. However, as the TVL across all DeFi product almost touched a whopping 90B this year, the question still remains. What exactly is the end game here?

Meet Anchor Protocol. Anchor Protocol is a savings protocol that provides anyone, even those with minimal exposure to crypto, a stable, high yield interest on DeFi. It’s built on Terra, and while the other protocols coming out soon are interesting as well (which we will focus on later on), today we’ll be talking about how exactly does the protocol work, and how you can get started on saving in Anchor.

So, what is Anchor’s interest rate?

Anchor gives you a stable interest of about 19.5% on average. To top it off, there is absolutely zero lock-up time and no minimum deposits on Anchor. That in itself is already better, and higher than the typical DeFi savings protocol for stablecoins. Aave gives you 1.6% on USDC, Compound a mere 1.44% with a 1-year lock-up.

How does Anchor work exactly?

I know what you’re thinking right now — “19.5%? That seems unstable.”, or “This seems too good to be true”. But hear me out, it’s not unstable, and it’s not too good to be true.

Apart from your typical borrow/lending features like banks or other DeFi protocols, the secret sauce for Anchor actually is only accepting liquid staking derivatives from PoS chains as collateral. As of now, Anchor accepts only bLUNA as collateral, but in the near future, one can expect bSOL and bETH to be accepted as collateral.

Knowing how these bonded assets work is how you truly understand why depositors get about 19.5% on average, while the rest of the other DeFi protocols cannot provide that stable yield.

Let’s illustrate this from a borrower’s and depositor’s perspective & then we can go on to how you can get started with Anchor yourself. Remember, there are no lock-ups or requirements, so if at any point you want to back out, or just want to test it out, you’re free to do so.

- High, stable income from depositing — Meet John. He has been investing in various cryptocurrencies for years, and has seen everything. Ranging from Bitconnect’s exit scam, and he is also a 2nd-degree connection to the guy that bought 2 pizzas for 10,000 bitcoins! He decides that now after all these years, he wants to tone down on the time spent investing in crypto and wants something more stable. He finds out about Anchor Protocol from Reddit, reads the docs, and realizes that this is the perfect protocol for him. He puts a deposit of $1 million in UST, and on average, gets back $195,000 per year (compounded every 6 seconds to make up 19.5% APY). Because there is no lock ups, John is also able to spend his yields every single month.

- Powerful yields with PoS assets — Meet Adam. Adam is a humble yield farmer by nature. His portfolio consists of every DeFi product available out there, and has tried out things like IRON/TITAN yield farming. However, he has assets like LUNA sitting in his wallet doing almost nothing. He said, “I tried Celcius, but it just doesn’t cut it, and it’s so complicated!” However, because he knows John, John decides to tell him that he can try out borrowing on Anchor — “It’s good, they give you up to 40% LTV on your bLUNA to borrow UST, and you can then put your borrowed UST to work by putting it back into Anchor and earn an extra 20%. Not to mention, they have rewards paid out in ANC tokens for borrowers as well (115% at time of writing).” Adam tries it out — he mints LUNA for bLUNA, and puts his bLUNA as collateral to work. The yield from bLUNA staking is then extracted by Anchor to give John his 20% APY. All in a few clicks.

As you can see as illustrated above, the yield a depositor can get is dependent on the borrower’s behavior. Bonded PoS assets held on its own, gets staking rewards. However, when you put a bonded asset as collateral, you forfeit the staking rewards, and these rewards in turn are used by Anchor to pay out depositors. But.. what happens when rewards from assets put as collateral is lower than the targeted yields? This is where the yield reserves kick in. Whenever rewards from the assets is more than the total payout needed to pay depositors, the extra money goes into the yield reserves. Think of it like a rainy day fund for… well when the days are rainy.

I’m excited! Let’s get started with Anchor — I want to start saving!

Hold up, before you try it out, there are some things you need.

- Terra Station wallet extension — available here

- $UST — purchased on any major exchanges, or DEXs.

After you have gotten your $UST from major exchanges, you can then proceed to send it to your Terra wallet, using your address found on the Terra Station extension (it should look something like “terra….”).

If you bought it from a DEX like PancakeSwap, or UniSwap, you need to bridge it over using https://bridge.terra.money/

That was FAST! I got my $UST, now how do I start saving?

It’s very simple, once you have gotten your $UST, simply head over to anchorprotocol.com, click on the WebApp on the top right, connect your wallet, and finally click on deposit. It’s as simple as that. To withdraw, simply click on “withdraw” and you should be able to take out your money.

Sweet! How do I start borrowing?

To start borrowing, you need to get hold of some $LUNA first. You can either:

- Buy it on major exchanges listed on CoinGecko. Port them over as usual like how you would with $UST.

- Swap it in Terra Station under “Swap” and start burning your $UST to mint $LUNA from there.

- If not, you can always head over to TerraSwap to do the same thing (Treat it like how you would with a normal DEX)

Once you have hold of some LUNA, head over back to Anchor Protocol, and click “Mint” on the top. We first need to mint some LUNA to bLUNA (The more liquid derivative that Anchor accepts as collateral so that you can borrow). Select how much LUNA you want to bond, and it will show you how much bLUNA you will mint. Also, select any one of the validators (they all have been whitelisted, so there’s any one is fine). Once you are happy, click “mint” and you’re good to go!

Once you’ve gotten your bLUNA, you now can head over to the “Borrow” section. First, scroll all the way down and find bLUNA under the “Collateral list”. Go to the most right side, click on “Provide” and start putting in bLUNA as collateral.

Once you are done with the transaction, scroll all the way on top and click on “Borrow”. Manually input the amount, or adjust the slider. It will also tell you the price that LUNA has to drop to until you get liquidated. Currently, the UI will stop you from going above 40% LTV.

My advice? Keep your LTV under 35% so that you don’t get liquidated in the case that LUNA has a price drop (unless you know how to code an auto repayment bot). So for example if you have $1,000 worth of bLUNA, borrow up to $350.

And that’s it! You’re done — now with your borrowed UST, you can put it back in Anchor’s deposit to have a negative interest on your borrowing while accruing ANC rewards, or you can go ahead and buy more LUNA (although that’s not recommended) and stake it!

Is it possible to reap the benefits of Anchor’s high yields on other stablecoins like BUSD, or USDC? I trust them more for now…

But $UST…. never mind. Yes, it is still possible! Simply said, there’s a protocol on Etherium that allows you to do this. It’s called Orion Money. In the case that you have other stablecoins that are sitting in your portfolio (maybe it’s funds saved for the dips, or because you heard USDT will pump to $2), you can still accrue interest of up to 20% on it! Orion Money is basically the front end of ethAnchor, and how the contract works is as follows in the simplest format:

- You deposit your stablecoin of choice on Orion Money Saver

- Orion’s contract work in tandem with ethAnchor — these stablecoins will then be converted to UST

- The converted UST will be put in Anchor Protocol, and in the case that you want to take it out, the contract just reverses!

De-Risking, and some neat features you should (but not need) to know

Anchor has been stable, but DeFi still comes with risks. This part is not necessary if you are only testing out Anchor, but if you are planning on putting in more money, you definitely need to know this.

- Currently, there is no native insurance, but however there is a 3rd party insurance called Nexus Mutual that will cover Anchor in the case of a protocol attack or smart contract failure. As of writing, it’s 2.6% per year, which is pretty neat because you still net about 17%+ with insurance.

- If you are worried about UST de-pegging, you can get insurance with Unslashed Finance that is coming soon. However, I’ve realized that the main reason why people are scared of UST, in general, is because of misinformation and lack of knowledge. If you want to learn more about UST, read this article.

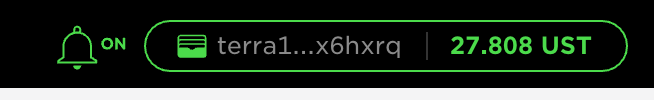

- If you are currently borrowing, you can set an alert for your LTV using the icon that looks like an alarm icon on the top right. Otherwise, there are bots out there created by community members* that can help you auto repay Anchor loans and keep your LTV below the liquidation percentage.

*These bots are not endorsed by TFL or by me, use them at your own risk. I am simply just forwarding you to a bot that I know other people have used, and made by someone I know.

Final Thoughts

Although Anchor is only a few months old, I trust the team behind it because of the speed at which ethAnchor was deployed and the fact there’s multiple exciting things coming up for Anchor. For reference, here are some (not limited to) of the things that will roll out in the next coming months:

- Auto-repay feature will be coming up in the next few months which will bring more trust & confidence in Anchor’s borrowing feature.

- Other PoS assets will be introduced as collateral, starting from bETH, then bSOL and potentially bDOT and bATOM — this will bring in fresh money for borrowing & unlock the potential of other PoS assets.

- Algorithmic adjustment of long-term Anchor rates, which alleviates the need of changing the rates manually through governance voting — which makes Anchor sustainable in itself.

- Native Insurance for Anchor in the case of a protocol attack or smart contract failure.

And much more.

Start heading over to Anchor Protocol and start saving! Your future self will thank you for reading this article and for saving your money in Anchor instead of traditional banks.

If you have any discrepancies with this article, feel free to shoot me a DM or message me. Not financial or legal advice, do consult a financial professional before you decide to make a serious financial investment!